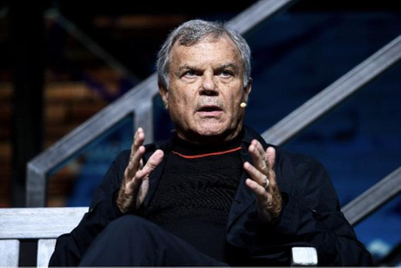

Martin Sorrell, the founder and former chief executive of WPP, has claimed that the “role of a CMO has got easier”.

Speaking at CES 2025 in Las Vegas, Nevada this month, Sorrell reasoned that four channels now represented “half the market” outside mainland China: Google, Meta, Amazon and TikTok.

Sorrell said that, in 2024, Google received $250 billion in adspend, Meta received $150 billion , Amazon received $60 billion and TikTok $40 billion. This accounted for half of global adspend, which totalled $1 trillion in 2024, as estimated by WARC.

WARC’s Q4 2024 report predicted that, across the year, 22.1% of adspend outside China would go to Google, with $197.7 billion being spent on search.

Sorrell added that he had spoken to the chief marketer at a “major global consumer goods” company, who agreed with him that his role had become easier. For the CMO, Sorrell said that the major issue was “how you get an organisation to change at scale with AI”.

Sorrell, who is also the co-founder of S4 Capital, which owns Monks, added: “You have to make personnel changes to reduce resistance inside the organisation.”

One of the examples he cited was an unnamed brand, at which there were 30 country-level CMOs reporting to country general managers. After the head of Europe was found to be “resistant” to the change AI brought with it, the organisation “moved him aside” and the country CMOs instead reported to a Europe-level CMO.

Omnicom/Interpublic merger

Sorrell has criticised Omnicom and Interpublic’s merger saying it represents “two companies huddling together when cold winds blow" and suggested that the merger could lead to as many as 10,000 job cuts.

He reiterated his criticism at CES, this time calling it the “oy vey merger”, a Yiddish phrase expressing dismay or exasperation.

Sorrell also questioned the motivation behind the merger, proposing that it “might be a little bit about John Wren [chief executive at Omnicom Group] wanting to be number one” and added that Philippe Krakowsky, chief executive of Interpublic, was “faced with a difficult situation” as IPG was under “huge” pressure.

Another possible reason for the merger, he added, was that the industry’s structure was “illogical. Clients are moving business from agency to agency at reduced terms. People are moving from agency to agency, often [at] increased terms, so have a compression.”

Campaign has contacted Omnicom and IPG for comment.

.jpg&h=334&w=500&q=100&v=20250320&c=1)

.jpg&h=334&w=500&q=100&v=20250320&c=1)

.jpg&h=334&w=500&q=100&v=20250320&c=1)

.png&h=334&w=500&q=100&v=20250320&c=1)

.png&h=268&w=401&q=100&v=20250320&c=1)

.png&h=268&w=401&q=100&v=20250320&c=1)

.png&h=268&w=401&q=100&v=20250320&c=1)