In what portends to be a watershed moment for global advertising, Omnicom Group and Interpublic Group (IPG) have unveiled their intention to forge a $31 billion advertising colossus—a union that would fundamentally recalibrate industry dynamics and eclipse WPP's long-held position as the sector's dominant force. The announcement arrives at an inflection point for Madison Avenue's holding companies, as they navigate an increasingly complex landscape shaped by technological disruption, evolving client imperatives, and the inexorable rise of digital platforms.

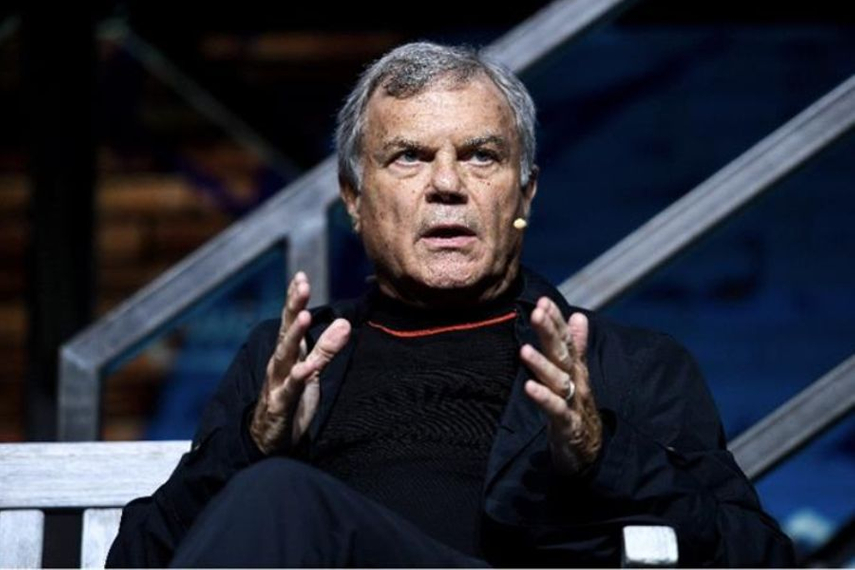

Martin Sorrell, whose three-decade tenure as founder and chief executive of WPP saw him architect the industry's most significant holding company before his 2018 departure, offers a particularly incisive perspective on the merger. Now heading digital advertising firm S4 Capital—itself navigating recent market turbulence and strategic reorganisation—Sorrell brings both historical context and current market insights to his analysis of this seismic industry shift. Whilst acknowledging his own current challenges—"I obviously would say this given where we are and I'm speaking my own book"—his extensive industry experience lends weight to his assessment of the deal's implications.

Speaking about the merger's strategic rationale, Sorrell cuts through the floating narrative that positions the union as a response to artificial intelligence's growing influence in advertising. While the combined entity's leadership suggests the merger will enhance their AI capabilities and help them compete in an increasingly tech-driven landscape, Sorrell dismisses this as misdirection. "The stuff about AI is a smokescreen," he explains, noting the stark contrasts in scale and efficiency between the agency world and tech giants. "If you put the total headcounts together it's over 125,000 between the two companies, while Google has a market cap of around $2.15 trillion with [some] 180,000 people... it's a very people-intensive business."

Sorrell asserts this focus on scale and efficiency masks deeper market pressures—explaining the merger's genesis lies in IPG's market vulnerabilities. "They certainly talked to Apollo and KKR," he reveals, adding, "In these cases, the strategic buyer won out because of the prospective cost synergies—they could pay a higher price."

These synergies however, come with significant human cost. Delving into the financial implications, Sorrell was notably specific: "[Omnicom CEO John] Wren said [on Monday] there will be $750 million in synergies, which will cost $450 million in [essentially] redundancy and compensation payments." His own calculation suggest significant workforce reductions: "That's probably about 7,500 jobs, maybe 10,000 if I'm going to cover this."

The integration challenges loom particularly large in Sorrell's analysis, especially regarding brand consolidation. While IPG CEO Philippe Krakowsky has cautioned against hasty brand mergers, Sorrell sees consolidation as inevitable. His assessment is informed by decades of witnessing similar attempts, pointing to previous unsuccessful mergers: "Look at the fallout now with Grey and AKQA, JWT and VMLY&R and other such agency consolidations," he points out. "We've seen it time and time again—slamming these businesses together without any thought from the client point of view or the people's point of view."

The management implications are equally challenging. Despite the merger positioning, he sees this as effectively "a takeover" that will result in significant leadership changes—with current power dynamics clearly favouring Omnicom, and IPG likely to see their influence diminish as the integration progresses.

With the industry's attention fixed on this leadership transition, such organisational upheaval creates natural openings for competitors. "As with any industry shake-up, the Omnicom-IPG merger opens doors for competition. Clients will inevitably reassess their options, especially if they feel uncertain." Yet despite this opportunity and the recent surge of consulting firms into creative territory—notably Accenture's investments—Sorrell remains sceptical about their ability to capitalise on the moment. "When I started WPP in '85, we were writing that the consultants would eat our lunch, and that hasn't happened," he says. The fundamental issue lies in the divergent economics: "If you're running a $50 billion dollar business, you need contracts... you don't need $5 million, $10 million, $15 million or $20 million. You need $100 or $200 million." This structural difference, he emphasises, means consulting firms may still view creative acquisitions more as relationship-building tools than core business drivers, limiting their appetite for major industry disruption during this period of consolidation.

Another key element: The geographical implications of the merger reveal both opportunities and significant vulnerabilities. While the combined entity will maintain a robust Western presence—"The proportion of the business in the US would be around 60%"—Sorrell notes concerning weaknesses in crucial growth markets. "They're not as strong in Asia as a result of this, or Latin America, or the Middle East," he explains. This geographical imbalance could prove problematic as these regions continue to drive significant advertising growth and client expansion.

The concentration in North America, however, could prove advantageous given current market conditions. "There is a deregulation feeling... and people are going to be doing a lot of deals. There's a lot of optimism about Trump's impact on the economy, lower taxes and lower regulation," he observes, adding he hasn't "seen America as bullish since Reagan."

Sorrell also argues this power shift within the merger reflects broader transformative pressures facing the industry. Elaborating on these challenges, he offered detailed perspective on market concentration: "The industry is a trillion dollars, and digital is now around $730 billion. Google's ad revenue is approximately $250 billion, Meta around $150 billion, Amazon's is over $50 billion, TikTok outside mainland China is around $25 billion. So, around $500 billion of the $730 billion in digital—out of the trillion-dollar total spend—comes from the four major digital platforms."

Looking forward, Sorrell predicts further seismic shifts in the landscape. Based on his conversations with industry leaders, he sees the Omnicom-IPG merger as just the beginning of a broader consolidation wave that could reduce the number of major holding companies from six to as few as three. The integration process ahead, he warns, will be marked by significant organisational upheaval and cultural challenges, with a projected two-year period of complex rationalisation across the merged businesses.

The initial response appears to support Sorrell's cautious outlook: "The market did not take it well," he notes, pointing to the initial 10% drop in Omnicom stock and mere 3% rise in IPG shares, levels which have changed little since the deal was announced as of Wednesday's close. However, these concerns extend beyond market sentiment to regulatory hurdles, with particular attention to Chinese approval—a factor that contributed to the collapse of Omnicom's attempted merger with Publicis Groupe in 2014.

As Sorrell characterises it, this merger represents "two companies huddling together when cold winds blow." Beyond the technology and AI narratives that dominated the announcement, he sees a starker reality: "Clients continually pitch business and new business at lower prices, people move from agency to agency at higher prices, so you have revenues going down and costs going up particularly in the traditional end of the business."

This fundamental pressure, rather than any strategic innovation, is what's truly driving the industry's consolidation. "This is not about revenue or revenue growth," he concludes. "This is about cost; this is about efficiency."

Campaign has reached out to Omnicom and IPG for comment.

.jpg&h=334&w=500&q=100&v=20250320&c=1)

.png&h=334&w=500&q=100&v=20250320&c=1)

.jpg&h=334&w=500&q=100&v=20250320&c=1)

.png&h=334&w=500&q=100&v=20250320&c=1)

.png&h=334&w=500&q=100&v=20250320&c=1)

.png&h=334&w=500&q=100&v=20250320&c=1)

.jpg&h=268&w=401&q=100&v=20250320&c=1)

.jpg&h=268&w=401&q=100&v=20250320&c=1)

.png&h=268&w=401&q=100&v=20250320&c=1)