S4 Capital, the brainchild of WPP founder Martin Sorrell, released its Q3 2022 results showing top-line momentum in the third quarter, with like-for-like gross profit/net revenue up over 29%, ahead of the performances of the technology companies and platforms.

The digital advertising group said it is trading in tune with its full-year top line objective of 25% like-for-like gross profit/net revenue growth and its profitability objective of operational underlying earnings of roughly £120 million ($143 million), adding that it had seen "little negative impact" so far from the current economic pressures.

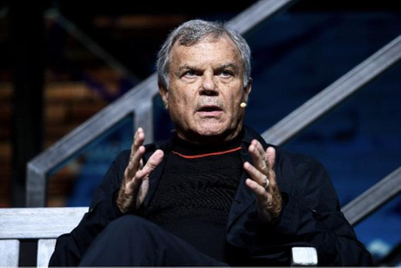

“Despite the current macro political and economic gloom and slowing tech growth, our top-line momentum has been more than maintained in the third quarter and remains relatively strong into the fourth quarter,” said Martin Sorrell, executive chairman of S4Capital.

“This is an enormous credit to our people and their ability to operationalise our purely digital, data-driven, faster, better, more efficient and unitary model, with all three practices growing their top lines strongly.

However, the firm admits that its data and digital media practice experienced some slowdown as Apple’s privacy changes cut into margins but overall, the third-quarter billings were up 51% at £484 million ($576 million) while revenue was up more than 68% to £300 million ($357 million) and gross profits were 73% higher at £250 million ($298 million). Year-to-date billings shot up by 46% at £1.3 billion ($1.55 billion), while year-to-date revenue stood at 63% higher at £746.5 million ($888.8 million), and like-for-like gross profits rose 64% to £625.2 million ($744.5 million).

Asia-Pacific, affected by China’s zero-Covid policy-driven slowdown, expectedly remained the slowest growing region for the agency. Here the reported gross profit/net revenue up 16% to £16.6 million ($19.8 million) in the third quarter and up 3% like-for-like. Year-to-date reported gross profit/net revenue grew 35% to £45.6 million ($54.3 million) and like-for-like was up 18%.

Shares rallied to a four-month high after the London-listed company revealed that earnings before interest, depreciation and amortisation (EBITDA) were also boosted by a control of hiring across the agency.

S4 Capital had earlier come under flak for its aggressive acquisition strategy–snapping up over 30 media groups in the last four years alone.

At the end of Q3, the number of people in the firm was 8,956, down 1% compared to 9,041 at the end of the second quarter, “reflecting more active and measured control of hiring across the Company,” S4 said.

The company believes the growth forecast of major platforms and like-for-like growth at Alphabet/Google, Meta/Facebook, Amazon, TikTok and the newer advertising platform entrants such as Microsoft, Apple, Netflix and Disney+, in particular, will offer substantial opportunities for it in 2023 and beyond.

S4 Capital is preparing a new three-year plan for the period 2023-25 and preliminary budgets for 2023.

.jpg&h=334&w=500&q=100&v=20250320&c=1)

.png&h=334&w=500&q=100&v=20250320&c=1)

.png&h=334&w=500&q=100&v=20250320&c=1)

.png&h=268&w=401&q=100&v=20250320&c=1)

.jpg&h=268&w=401&q=100&v=20250320&c=1)

.jpg&h=268&w=401&q=100&v=20250320&c=1)

.png&h=268&w=401&q=100&v=20250320&c=1)