For a long time, publications such as this one have been reporting that APAC markets lag behind those in the west in adoption of data-led, programmatic digital advertising. Fingers have been pointed at lack of digital knowhow and talent, lack of budget, lack of tools and lack of will (or lack of clue) among senior company leadership.

While many of those issues were and/or continue to be real ones, another factor tends to get less attention: a relative lack of reliable data. While it doesn't interfere with all marketing objectives, this data deficit definitely holds back progress for certain phases of marketing and certain kinds of companies for whom targeted digital marketing is most useful. And it's a painful fact that this lack of data creates a massive blind spot right where it would be most helpful: making consumers in some of the world's fastest-growing markets easier to reach with pinpoint accuracy.

Fortunately, companies are at work trying to improve the situation, including one particularly significant owner of customer data in this region. There's even a chance that the ecosystem here could evolve in a way that's different from the duopoly-controlled regime that holds sway in the west.

The gap

Many savvy companies are getting their house in order in terms of organising and making use of their first-party data (the data they own about their own customers). But when it comes to seeking new customers, marketers need to turn to outside data sources to define and target audience segments. While this is sometimes data procured through a close partnership (second-party data), more often than not it's third-party data—sold and bought through an open market.

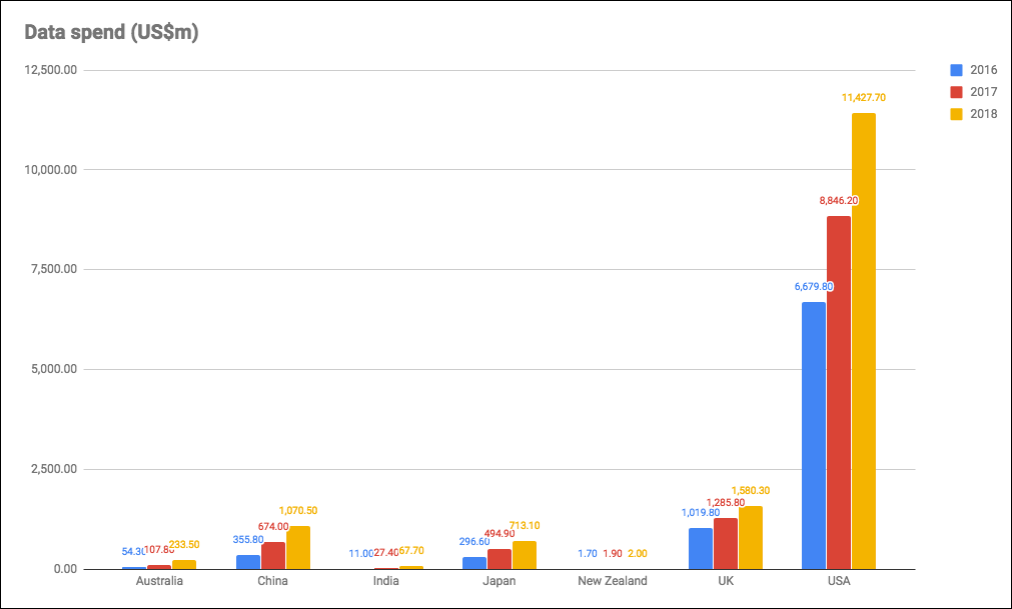

However, that market in APAC is a fraction of its size in the west.

"It isn't as rich as what is available in EMEA or more specifically in the UK or North America, where a lot of data providers give you a fair amount of sharpness and robustness," confirms Deepika Nikhilender, APAC senior vice president with GroupM's Xaxis, which focuses on helping clients optimise their programmatic efforts. She adds that much of the data vendors do offer is built up using probabalistic means; a small verified data set gets extrapolated to a larger data set, which can result in unreliable data and poor results when that data is put to use.

"Specifically in APAC, there is considerable lack of reliable data for brands, especially in developing markets," agrees Philip Smolin, global chief strategy officer with Amobee, the Singtel-owned marketing-tech company. "The right data—which informs everything from better understanding and reaching current customers to making creative decisions and improving campaign performance—empowers a higher level of consumer understanding that, in turn, creates an ability to cultivate a highly personalised consumer journey."

UK and US included for comparison. (Chart by Campaign Asia-Pacific)

Asked to provide a sense of the size of the data gap between the west and Asia, Evgeny Popov, vice president of data solutions for APAC at Lotame, a DMP (data-management platform) provider, explains that Asia is missing a data source that accounts for 50% to 60% of the data market in North America.

A wide range of data is available via publishers and others who track online behavior in APAC, of course. "But what's lacking is there is not much offline data outside of that realm which can be brought online," Popov says. The US market, by contrast, has a rich ecosystem where onboarding capabilities for client data are more evolved, he says, adding that the 50% to 60% that's missing here comes from offline sources such as CRM databases in western markets.

"It's not that that data doesn't exist," Popov adds. "Plenty of that data exists. A lot of companies have a lot of client-data assets. It's just there's an inability to onboard that data at scale. That's the current problem in Asia."

Smolin paints the picture more dramatically. Whereas a major influx of data from, say, a telco, would be a 1% drop in the bucket in the North American data market, a similar input could increase the volume of available data in a market like Indonesia by 1000%, he says.

There's ample demand from marketers, according to James Prudhomme, head of international at Index Exchange. "From a buy-side perspective, there is certainly a strong appetite for clean and fresh third-party data across the region," he says. "In line with the movement towards greater transparency throughout the programmatic ecosystem, we are seeing buyers wanting to access data knowing where it has been sourced as well as the quality and usability of the data itself."

Many of Index Exchange's buy-side partners are looking for unique first-party data layers, "particularly in the private deal space", as they recognise the importance of how that data is collected and refreshed. "To compliment this from a third-party standpoint, we’ve seen positive movements from DSPs who are offering telco data as a point of differentiation in market. The interest from buyers for data of this nature is a representation of the readiness and openness of brands and their agencies to utilise trustworthy and accountable data sources to make better informed trading decisions."

On the other hand, Nikhilender believes lack of quality data has fed a belief among some marketers that third-party data is a questionable investment.

In general in Asia, data sets that provide sharpness, accuracy and perhaps most critically scale sufficient to meet marketers' objectives are scarce, she says. "And if you don't get it, if it doesn't give you that scale, it doesn't give you that ability, even with lookalike modeling, to create scale, usually the next thing people do is shun away from it." Hence the general tendency in the region has been to focus on building first-party data for the time being.

A related factor in Asia, according to Nikhilender, is what she calls a "mad rush" to efficiency. Marketers and agencies are always in pursuit of the lowest possible CPA (cost per acquisition), sometimes without much regard for the quality of those acquisitions.

Put simply, third-party data just "doesn't yet have a place of respect and regard in the marketers' mind to the extent, in a much more omnipresent way, that it has in America and the UK", Nikhilender says.

Global events in recent months have only added to the atmosphere of caution. In March, Facebook, facing fallout from the Cambridge Analytica scandal, shut down its Partner Categories function, an offering that had allowed companies to use third-party data to target users on Facebook. And then of course GDPR (the General Data Protection Regulation) kicked in across Europe in May. While that transition went more smoothly than many expected, markets in Asia, including Indonesia and Philippines, seem to be embracing GDPR-like regimes, Smolin says.

Filling the gap

To get more enthused about using third-party data, marketers need to see that it's as deterministic as it can get, that there is transparency about where the data is coming from and that it can give them adequate scale to reach their potential universe of customers, Nikhilender says.

For its part, Xaxis, as part of GroupM, touts the mPlatform offering, which claims to offer "the most complete consumer profiles", including demographics, technology usage, behavioural insights, purchase history, location data and more. The company aims to provide data that are as deterministic as possible, Nikhilender adds. Other media-agency groups are making similar efforts.

However, she also expects mPlatform to face growing competition as the number of players interested in monetising their data wares increases. "It's already a reality to some extent, and perhaps that's what's going to fuel the richness of the data here [in APAC], as more people start collecting their own data and begin to look for monetization approaches," she says, mentioning Grab as one example of a data-rich company.

Telcos are another example, and probably the one with the deepest pools of rich data. "Operator data can help solve the broader marketing needs within the region and allow for personalization, relevance, and a more seamless experience that consumers have come to expect," Smolin says. They have a very unique and truly at-scale data asset, he adds, including CRM profile information, visibility into the 'clickstream' and location data, all of which is based on device IDs, which equate to individual phones.

"The other component of that data set that they have is not just the data itself, but the consumer relationship," he says. "Because there's a limited number of brands in any country market that have a direct, first-party relationship with consumers, at scale, where you're talking 50% to 60% of an adult population."

That creates unique opportunities, he says, because in post-GDPR world, the ability to speak directly to consumers and get their consent for use of their data is both respectful to them and commercially powerful.

It just so happens that Amobee's parent company, Singtel, owns Australian telco Optus, and has stakes of various sizes in Bharti Airtel (India, South Asia and Africa), Telkomsel (Indonesia), Globe Telecom (Philippines) and AIS (Thailand). The Amobee platform is the result of $1 billion in investments, most recently the $310 million acquisition of Turn at the start of 2017. You can safely bet that a belief in the lucrative nature of its telco data was a big motivation behind those investments. And indeed, since the Turn acquisition, Smolin says, the company has been at work executing on a strategy to unleash operator data for marketers.

Campaign Asia-Pacific is among the first to hear the company explicitly outline this strategy. Eighteen months of integration work since the Turn acquisition is coming together, Smolin says, although the company declines to share a specific timeline for availability.

"Working closely with Singtel and its regional operators and affiliates across APAC, Amobee is focused on building a differentiated, competitive marketing stack to make unique operator data assets accessible to marketers," Smolin says. "Amobee’s operator-data solutions will be available through the Amobee platform and help leading brands and agencies, including operators, engage their audiences and activate with global scale from one unified platform."

Smolin argues that what Amobee will be able to offer is superior in a couple of ways to what marketers in western markets experience. There, he explains, telcos are buying up media properties and working to create their own walled gardens, which will sit alongside the ecosystem's existing walled gardens (Facebook and Google, primarily).

By contrast, Singtel is creating a platform that is effectively media agnostic, he says. "If you picture those siloed walled gardens sitting next to each other, what Singtel has created with Amobee is a horizontal layer that can bring a telco's data into marketing for activation and analytics and create a lot of value out of that, but doing so where it's applied across walled gardens, as opposed to trying to be one of the walled gardens."

This both eliminates concerns about conflict of interest and simplifies procedures for marketers whose main concern is orchestrating consumer journeys across all media, he argues. Notably, it cuts down on the need to port data from platform to platform, a process that typically results in attrition of the data set.

Lotame's Popov, who wonders why telcos haven't made this data available long ago, agrees that an influx of device-ID data could be helpful, but noted that portability is also important.

"If it's explicitly for Amobee clients, it's still, to me, a walled garden in a sense, because it's limited in scope of who can accept that data," he says. "If this data is transactable...then definitely that would be a good step forward."

Meanwhile, Lotame has been making its own efforts to provide marketers with more reliable data. The company's Precision Audiences offering, which is rolling out in markets in Asia now, comprises audience segments that are validated through “continually on” tests with research panels. This allows these data sets to exceed industry accuracy benchmarks, which translates to greater ROI, the company says.

"I really hope that by 2020 we can, as an industry, not just guarantee accuracy, but actually start transacting on accuracy in the way we've been transacting on viewability on the media side," Popov says. "By saying, you know, you only pay for data if it's accurate. Obviously, we'll extract premium CPMs for this kind of data point, but I think that's where the industry is going."

+(900+x+600+px)+(3).png&h=334&w=500&q=100&v=20250320&c=1)

+(900+x+600+px).jpg&h=334&w=500&q=100&v=20250320&c=1)

.jpg&h=334&w=500&q=100&v=20250320&c=1)

.jpg&h=334&w=500&q=100&v=20250320&c=1)

+(900+x+600+px).png&h=334&w=500&q=100&v=20250320&c=1)

.jpg&h=334&w=500&q=100&v=20250320&c=1)

+(900+x+600+px)+(2).jpg&h=268&w=401&q=100&v=20250320&c=1)

+(900+x+600+px)+(3).jpg&h=268&w=401&q=100&v=20250320&c=1)

+(900+x+600+px).png&h=268&w=401&q=100&v=20250320&c=1)