Google is preparing to join the growing list of tech behemoths entering the banking arena by announcing plans to partner with US banks and credit unions to offer current accounts.

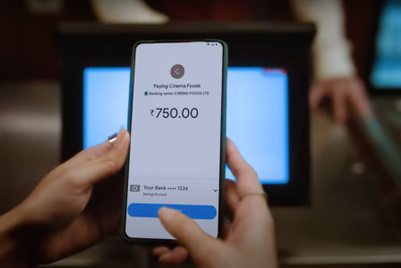

With its "smart checking accounts", users will be able to use Google Pay in its current guise as a payment system but also keep money in accounts managed by the company,

Google already works with banks and payment providers. In the UK, these include Halifax, HSBC, Lloyds Bank, Metro Bank, Nationwide, Royal Bank of Scotland, The Co-operative Bank and TSB.

This latest move would extend Google’s reach beyond payment (via Android phones and online) into the current account arena. The tech giant said that the company and its US partners—currently Citigroup and Stanford Federal Credit Union—would start to offer accounts in 2020. It will seek to add more partners and will undoubtedly look at markets outside the US.

Google said the accounts would help "customers benefit from useful insights and budgeting tools, while keeping their money in an FDIC or NCUA-insured account". This means that the accounts would be provided by the banks themselves.

"We believe our partners' regulatory and financial know-how is a great complement to our experience in building helpful tools and technology for our users," Google said in a statement.

Google will join the ranks of tech businesses such as Amazon, which offers credit cards and loans; Apple, with its Apple Pay smartphone payment app and Apple Card; Facebook, which has said its Facebook Pay services will complement its messaging tools; and Uber, which offers a credit card.

While Amazon and Uber’s offerings are designed to boost spend within their own ecosystems, Google and Facebook’s services are aimed at driving spend with third parties, many of which will advertise on their platforms.

The news of Google’s entry into financial services will raise questions among critics concerned about competition, transparency and data protection.

Such concerns have already resulted in investigations in the US. Apple has attracted an inquiry by a US finance regulator over its apparent "sexist" credit card, which Apple co-founder Steve Wozniak said used algorithms that gave more favourable credit limits to men compared with women.

.jpg&h=334&w=500&q=100&v=20250320&c=1)

.jpg&h=334&w=500&q=100&v=20250320&c=1)

.jpg&h=334&w=500&q=100&v=20250320&c=1)

.jpg&h=334&w=500&q=100&v=20250320&c=1)

.jpg&h=334&w=500&q=100&v=20250320&c=1)

.jpg&h=268&w=401&q=100&v=20250320&c=1)

.png&h=268&w=401&q=100&v=20250320&c=1)

.jpg&h=268&w=401&q=100&v=20250320&c=1)